Rents continue to remain persistently high

Average rents across the nation remain stubbornly high. The average U.S. rent increased by 0.58% month-over-month (M-O-M) during April, significantly higher than growth rates during February and March, which increased 0.30% and 0.46% respectively. The current M-O-M increase of 0.58% extrapolates to a 7.0% expected annual increase. This is above the current year-over-year (Y-O-Y) increase of 5.26%, suggesting that continued increases in rents are likely.

This study is an ongoing, monthly report co-produced by the Alabama Center for Real Estate (ACRE) at the University of Alabama, Florida Atlantic University Real Estate Initiative, and Florida Gulf Coast University’s Lucas Institute for Real Estate Development & Finance.

Bennie Waller, PhD, of The University of Alabama’s Culverhouse College of Business said, “this national trend indicates that rental relief is not on the immediate horizon, particularly in the largest metropolitan areas.” For example, for the month ending April 2023, New York had a rent premium of 8.54% and a M-O-M increase of 1.28% which extrapolates to over a 15% annual increase as compared to the current year-over-year (Y-O-Y) increase of 6.6%. There were no M-O-M declines in the top 50 metro area and only five in the top 100 all with a decrease of less than .50%. Changes in M-O-M rents can be found on the ACRE website.

Further evidence of rent persistence is that 18 of the top 100 metro areas report M-O-M increases of at least 1% with this highest being Poughkeepsie, NY at 3.29%. “This is surprising given the slowdown in M-O-M increases that we have recently been seeing,” said Ken H. Johnson, PhD, an economist in FAU’s College of Business. “It is common to see an increases in M-O-M rents in the Spring, but these levels are particularly worrisome.”

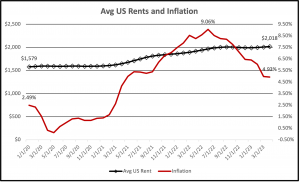

As shown in Figure 1, the monthly percent changes in rents and inflation are very much intertwined. Both average US rents and inflation were decreasing prior to the onset of COVID-19 in early 2020 after which both rent, and inflation increased rapidly and remain above pre-COVID levels. Rents over the period (January 2020 – April 2023) increased from $1,579 to $2,018 and inflation from 2.49% to 4.93% with inflation peaking at 9.06% in June 2022.

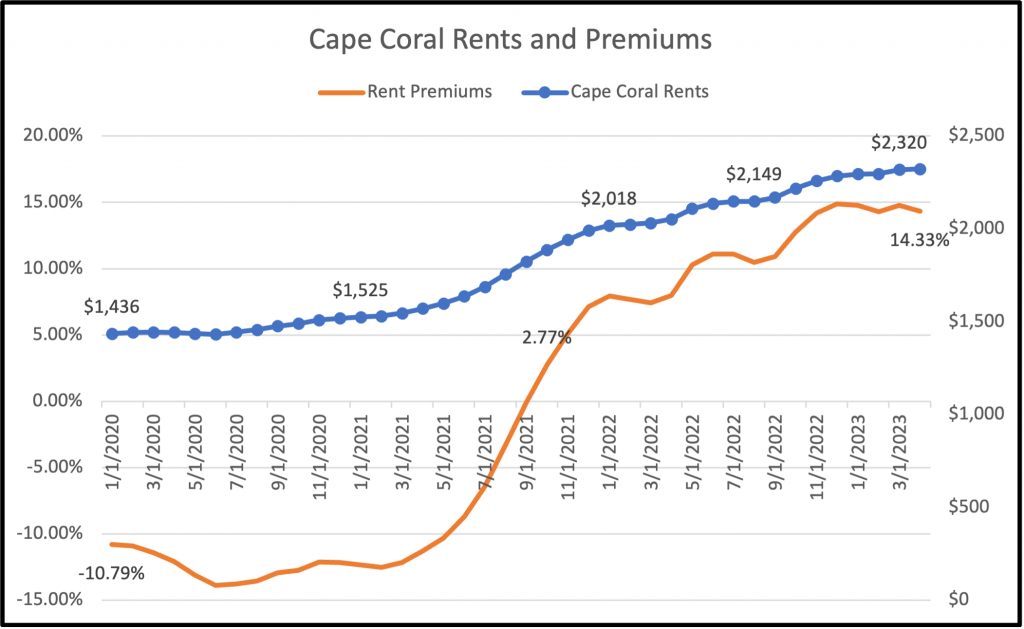

Rents in Florida, the “sunshine state”, continue to have some of the most overpriced rents in the country. Four of the top 10 overpriced metro areas are in Florida include double digit premiums in Cape Coral (14.33%), and Miami (10.84%), as well as North Port (9.74%), and Deltona (7.69). Tampa ranks 11th with a rent premium of 7.47%.

“Once again, southern states are leading the way with eight of the top 10 highest premiums. This is almost certainly being driven by the rapid influx of population into these states,” said Johnson. The top three metro areas have double digit premiums and are from Florida and Texas with premiums of 14.3% (Cape Coral), 10.8% (Miami) and 10.4% (El Paso).”

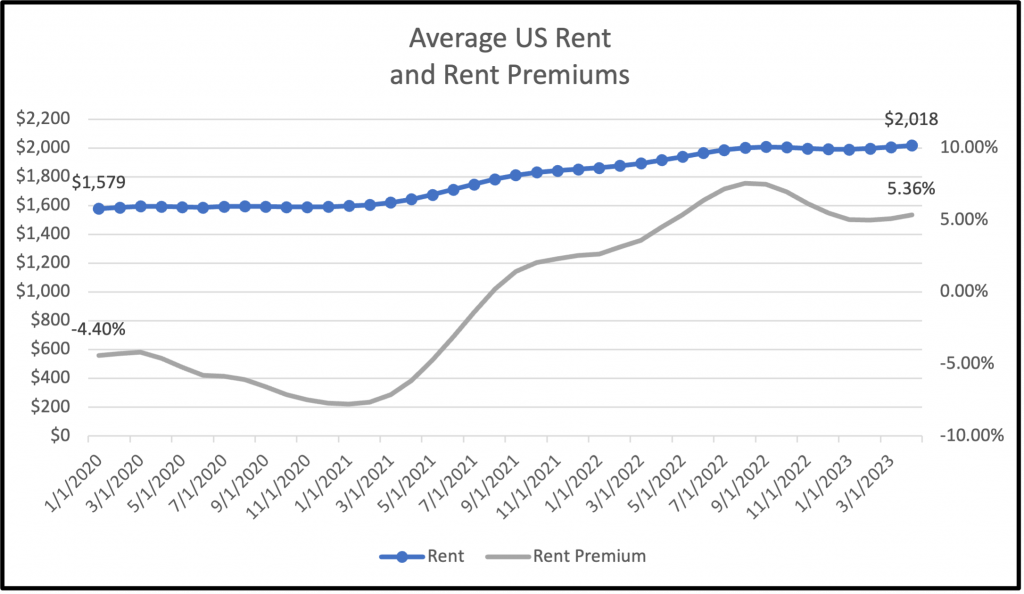

Many areas have seen differing degrees of rents and rent premiums as shown by the three figures below: United States, Cape Coral, FL and Birmingham, AL. Figure 2 below depicts average US rent and rent premiums over the period January 2020 – April 2023, where rents increased from $1,579 to $2,018, an increase of 27.8%. Over the same period rent premiums went from -4.40% to 5.36%.

In comparison to US rents, Cape Coral has seen rents explode from $1,436 to over $2,320, an increase of 61.6% and a rent premium of 14.3%. As illustrated by Figure 3 below, rents started to quickly escalate in early 2021 as did rent premiums. The Cape Coral metro area was impacted hard by Hurricane Ian and is still recovering and will be for a while, as rents increased by almost $200 since the storm made landfall in September of 2022. “While rent growth in SWFL had moderated prior to the storm, the region lost thousands of housing units in the storm renewing the upward pressure on rents. The area has a number of new projects coming online in the next year or so but these new units will likely command premium rents and do little to alter the current trajectory of market rents,” said Shelton Weeks, PhD, of Florida Gulf Coast University’s Lucas Institute for Real Estate Development & Finance.

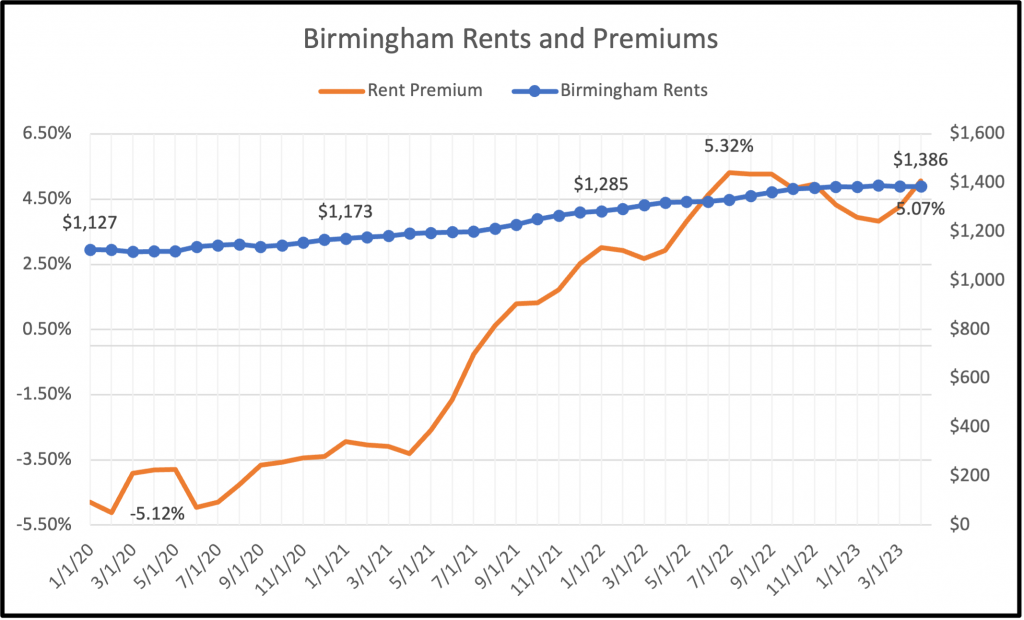

Finally, contrast rents in Birmingham, AL to the US, where rents over the same period increased by 22.98% ($1,127 to $1,386) in Birmingham as compared to the US and Cape Coral, which saw increases of 2.78% ($1,579 to $2,018) and 61.6% ($1,436 to $2,320) respectively. Birmingham experienced rent premiums ranging from a low of -5.12% in February 2020 to a high of 5.32% in July 2022 with a current premium of 5.07%.

“These results provide a strong indication that the rental crisis and inflation are largely intertwined with no relief on the immediate horizon for most of the top 100 metropolitan areas. I encourage readers to explore our results. They are easy to access and interact with, allowing readers to dig down into their local area outcomes for rents. The Waller, Weeks, and Johnson (W,W, & J) monthly rental index is published with the goal to assist consumers, real estate owners, and property managers with data to make more informed decisions,” said Bennie Waller, PhD, of The University of Alabama’s Culverhouse College of Business.

Complete interactive data for both the US and Alabama can be found here.